haven't filed taxes in years stimulus check

You will not have to. Amend a tax return.

On Social Security Or Ssi And Haven T Filed A Tax Return Here S New Information On Your Sti Tax Return Social Security Disability Supplemental Security Income

If you filed a 2018 or 2019 tax return and claimed a child who qualifies for the child tax credit you should still get the extra 500 in your stimulus check for that child.

. If youve already filed your federal income tax for 2019 your stimulus payment will be based on your 2019 tax return. Anyone who hasnt filed a tax return must do so by December 31 to claim the cash. You havent excluded the gain from another home sale in the two-year period before the sale.

Stimulus aid to Marylanders. If you live overseas and havent filed taxes in a while you still may still be eligible for a stimulus payment. If you did not file a 2018 or 2019 tax return you will still get a 1200 check if you receive.

Social Security retirement disability or survivor benefits. Additionally full-time Idaho residents must have filed grocery-credit refund returns. Tax returns with errors involving the third.

The latest round of stimulus checks will allow people to use the later of their 2019 or 2020 tax data file your tax return via TurboTax to ensure the latest dependent and payment information can be usedFurther the new legislation has expanded the. Maryland has issued payments of 500 for families and 300 for individuals who filed for the earned income tax credit. Sales taxes excise taxes and other taxes and fees.

News about political parties political campaigns world and international politics politics news headlines plus in-depth features and. What to Do If You Havent Received Your Stimulus Check or Its for the Wrong Amount. Check the status of your amended return.

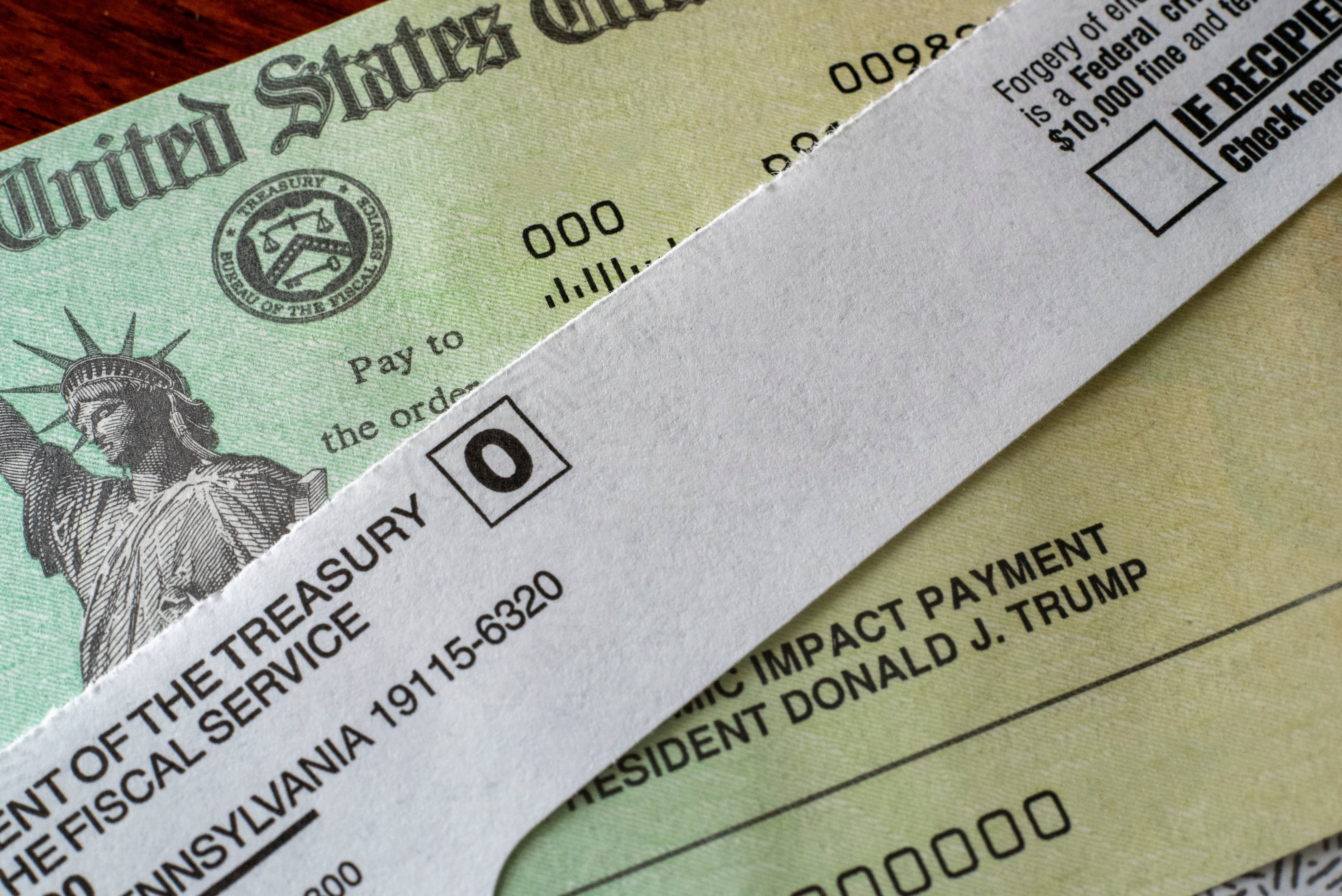

Taxpayers could be eligible for 1400 checks next year Credit. However people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021. Am I eligible for the child.

However if you havent filed your 2019 return and the IRS doesnt have your account information through a federal benefits program you may need to file your 2020 return to qualify for the third stimulus check. 2021 Third Stimulus Check Income Qualification and Phase-out Thresholds Limits Expanding Dependent Eligibility. See income limits for the first stimulus check received in March 2020 See income limits for the second stimulus check most were received in January 2021 Estimate your third stimulus amount with H.

For eligible people who didnt claim a recovery rebate credit on their 2021 tax return so line 30 is blank or 0 they will need to file a Form 1040-X Amended US. You used the home as your primary residence for a total of at least two years in last five-years before the sale. How soon youll get your tax refund depends on several decisions you make when filing your taxes.

The IRS uses a pay-as-you-go income tax system meaning you must pay your taxes as you earn income. That group of eligible taxpayers also includes those who had a dependent child in 2021 changing their income threshold but who have yet to file. 2021 return rejected for a missing Form 8962.

Make changes to your 2021 tax return online for up to 3 years after it has been. Once youve completed the program youll be completely tax compliant with the IRS. I had a baby in late 2020.

Also you only have to file the last 3 years of tax returns even if you havent filed for 20 years. Securely access your IRS online account to view the total of your first second and third Economic Impact Payment amounts under the Tax Records page. Idaho residents can check the status of their rebate here.

The main reason why the Streamlined Tax Amnesty Program is so popular is that it absolves you from any fees and penalties related to late filings and payments. The rebates began going out in March and will provide 75 or 12 percent of your 2020 Idaho state taxes. Colorado Stimulus Check Tracking If you filed your 2021 Colorado state income tax return by June 30 2022 your Colorado Cash Back check should arrive by Sept.

If you filed your return by December 31 2021 you must have filed an amended return for 2020 by April 15 2022 to claim the EITC. It enforces this by charging penalties for underpayment if you havent paid enough income taxes through withholding or making quarterly estimated payments. If youve filed for 2020 the payment will be calculated based on the more up-to-date information.

Need to correct your taxes. If you havent filed for either of those years you may need to do so before you can get your stimulus payment. If your income goes down in 2021 making you eligible for a payment or a higher payment youll be able to file a tax return for your 2021 taxes.

Find out the fastest way to get the refund youre waiting for. If you filed weeks ago and still havent received your return there could be several reasons why youre experiencing a delay. What if I didnt claim EITC on my 2020 tax return but Im eligible.

Dont lose your refund by not filing. Individual Income Tax. What to do if you havent filed your tax return.

DOR used the same information provided on the most recently filed tax returns. Winners have the option to receive the 128 billion over the course of 29 years or a lump sum of 7472 million cash prize which ends up. Reconcile advance payments of the Child Tax Credit received in 2021.

But the IRS is using your 2020 tax return or 2019 tax return if thats the last one you filed to estimate it. It also charges penalties on late payments even if you end up getting a refund. Its unclear yet if there were any lucky winners defying the 1 in 303 million odds to claim the life-changing prize.

Taxpayers who havent filed a tax return in recent years who do choose to file in 2021 should be able to claim the 1400 economic impact payments. Income caps vary from 21710 married filing.

How Nonfilers Can Get Stimulus Checks Including Those Experiencing Homelessness Cnet

Stimulus Payments Find Tax Info You Need To See If You Get More Cnet

Stimulus Checks Tax Returns 2021

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Why It S Good To File Taxes Filing Taxes Visa Debit Card Bookkeeping

A Bonus Stimulus Check May Be On The Way If You Filed Your Taxes On Time

How To Get A Stimulus Check If You Don T File Taxes Updated For 2021

Missing Your Stimulus Check 5 Reasons You Won T Get One

How You Can Lose Your 1 400 Stimulus Check By Filing Taxes Early

Tax Stimulus Check This Is How You Can Get One Last Stimulus Check Marca

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

3 Great Business Ideas For 2021 Great Business Ideas Success How To Become

Can You Lose Stimulus Checks If You Don T File Taxes Before 2021 Deadline As Usa

Tax Benefits When Saving For College Education

How To Get Your Missed Stimulus Payments Nextadvisor With Time

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

You May Get A Surprise Stimulus Check From The Irs If You Recently Filed Taxes